If you are looking to lower the interest of your loan, then you may go for refinancing. You can check out various refinance mortgage rates offered by different lenders and choose the one which is the best for you.

Some reasons for refinancing are given below:

• Want to make lower monthly payment: You have already purchased your home and have to pay certain fixed interest-rate for the mortgage. Now, you find that the interest-rate have lowered down. Refinance your mortgage rates by exchanging the previous higher interest rate with the current lower one. Thus, you will have to make lower monthly payment.

• Want to go for lower interest rate: Do you know how long you are going to stay in your house? No? Then don’t go for adjustable rate mortgages (ARMs). In ARMs, the rate remains low [generally much lower than the fixed rate] for the initial 3-5 years, but, after that the rate goes up with every year and you may be a loser. On the other hand, if you are sure of staying at a house for several years, then it will be beneficial to you to opt for a fixed rate instead of the fluctuating adjustable rate. Then you will have the security of paying a fixed amount monthly without bothering about the market rates.

•Need extra money: Want to remodel your home or pay off high-interest rate bills or pay for the tuition fees for your kids? Then opt for refinance.

•Your equity has become more than 20%: When you had taken the first mortgage loan to buy a house and had failed to make a down payment of 20% of the loan amount, you were required to purchase a Private Mortgage Insurance (PMI). If you have steadily repaid your mortgage till now, your equity may have become more than 20%. At this time, if you apply for refinancing, you will not need PMI anymore.

The house which you bought before with mortgage is a big asset for you. So you need to go through different refinance mortgage rates and find out the one which will prove to be the most beneficial for you.

PS: If you like this article ... Please Subscribe to our mailing list.

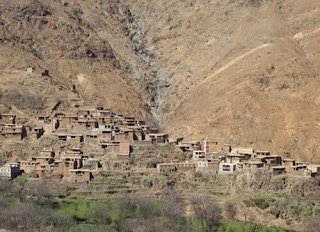

Rural World in Morocco

Rural World in Morocco