PlaNet Finance Logo

PlaNet Finance is an international non profit organization whose mission is to fight against

poverty through the development of microfinance to improve access to financial services for the poor who are excluded.

Since its inception in 1998, PlaNet Finance has developed a group of organizations (PlaNet Finance Group) offering a diverse range of services. These entities are composed of dedicated and specialized team with more than 1 000 professionals.

Based in Paris, PlaNet Finance's international network and are active in nearly 80 countries.

PlaNet Finance Morocco is a Moroccan non-profit organization founded in 2002, which has its management structures and its Board of Directors, whose enrollment to date is 17 people.

PlaNet Finance Morocco is affiliated to PlaNet Finance Network World.

PlaNet Finance Morocco is as a facilitator for the

microfinance sector in Morocco. It offers its services to microcredit associations, public authorities and donors.

PlaNet Finance Morocco has completed its action plan and has achieved since its inception in June 2002, the development of practical and useful tools to develop and operate by the AMC themselves. She continues to support the CMA in Morocco from two levels of intervention:

Objectives at the sectoral level:

• Maintain and develop the tools already in place: the portal, mapping, Central Risk

• Continue training of direct and indirect stakeholders in the sector: PFM is a training center, information, research and technical support

• Provide funding: MAC help in accessing funding through the establishment of fund financing

• Expand the supply of services of AMC: extending the offer beyond microcredit

Objectives at the individual level:

• Supporting new entrants: Microcred,

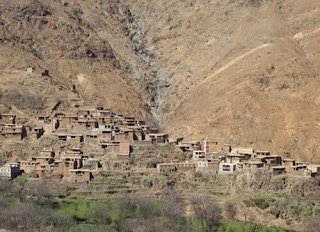

• Target new populations: awareness of women, rural people, young people in precarious situation

• Strengthen the smaller AMC level institutional

• Propose specific expertise to the largest AMC, public authorities or other .

Related: The Best Books You Must To Read Click Here

P.S: If you like this article ... Please Subscribe to our mailing list